Decentralised Finance (DeFi) and Centralised Finance (CeFi) represent two distinct approaches to managing financial transactions and assets. Asides becoming a topic of great interest, they also opened up debates on the question-who controls our money? For instance, the Cardano blockchain launched the MuesliSwap mainnet in its debut into the DeFi ecosystem on January 2, 2022. Data from DeFiLlama reveals that the Total Value Locked (TVL) in the Cardano DeFi ecosystem soared to an impressive $161.75 million by May 2023, a remarkable year-to-date growth rate of 229% from $50.097 million at the beginning of 2023. On the other hand, at the end of Q2 2023, the global crypto market cap stands at $1.16T. In Q1 2023, the top ten centralised crypto exchanges accounted for most of all trading at $2.46 trillion.

In this blog post, we will delve into the key differences between DeFi and CeFi, exploring their unique benefits and discussing their implications for the future of finance.

A Walk through Definitions: What is DeFi?

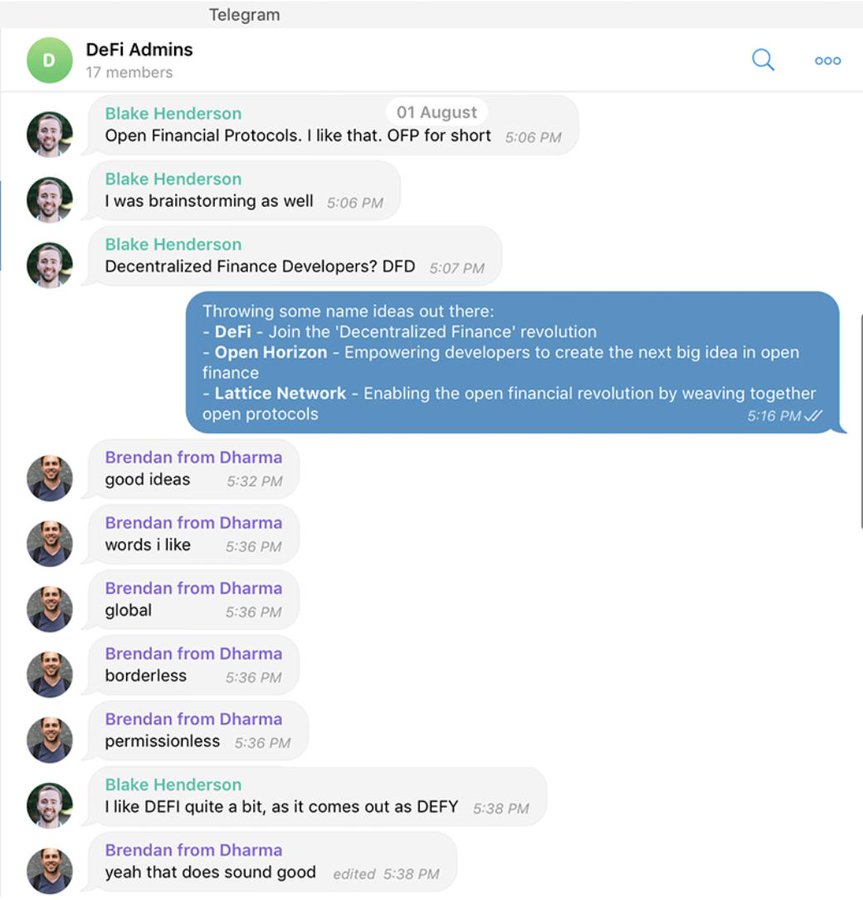

Decentralized Finance was a foreign concept to the world of Finance until it was coined in August 2018. A new era was born via a Telegram chat between the developers of the world’s second-largest blockchain Ethereum. The chat included Developers such as Blake Henderson of 0x, Set Protocol’s Inje Yeo of Set Protocol and Brendan Forster of Dharma. DeFi is a financial ecosystem built on blockchain technology, where financial transactions and services operate without the need for intermediaries such as banks or brokers. DeFi platforms leverage smart contracts to automate and execute transactions, enabling users to access financial services in a decentralized and permissionless manner.

Source: Twitter

Think of your bank and the excess charges you have to pay. For instance, you are charged a monthly minimum balance fee which means you have to pay the bank to keep your funds for you asides from the other service charges and maintenance fees you have to pay. Also, your minimum balance fee can drive your balance into a negative leading you to an overdraft fee. According to the Fintech And Financial Inclusion report by Business Insider Intelligence in 2019, 53% of self-reported households do not have an account because they do not have enough money to keep in a bank account. However, with Decentralised Finance, users can easily open an account and only get to pay gas fees or network transaction fees which are charged only when a transaction takes place.

Anyone can access DeFi applications and protocols without having to provide personal information or go through KYC (Know Your Customer) processes as it is permissionless. Furthermore, users do not have to trust any third party or central authority to manage their funds or transactions. It is a trustless system that enables users to rely on smart contracts, which are self-executing pieces of code that enforce the rules and logic of each application or protocol. Unlike CeFi, DeFi is non-custodial and users have full control and ownership over their funds and assets. They do not have to deposit or store them in a central platform or exchange. Instead, they use their own wallets and private keys to interact with DeFi applications and protocols.

Advantages of DeFi

Financial inclusivity and access: DeFi opens up opportunities for unbanked or underbanked individuals to participate in global financial markets and access services like lending, borrowing, and investing.

Transparency and trust: DeFi leverages the transparency and immutability of blockchain to provide users with visibility into transactions and smart contract codes, fostering trust and reducing the need for intermediaries.

Eliminates intermediaries and reduces costs: DeFi eliminates the need for traditional intermediaries, reducing costs associated with fees, delays, and bureaucracy.

Exploring Centralised Finance—CeFi

Centralized Finance is a concept that also utilises blockchain technology. However, while DeFi is decentralised, CeFi represents the traditional financial system where intermediaries such as banks, exchanges, and brokers facilitate financial transactions and have more control over users’ assets. CeFi platforms operate under regulatory frameworks, ensuring compliance and customer protection. For instance, in the United States, Crypto exchanges fall under the regulatory scope of the Bank Secrecy Act (BSA). Hence, cryptocurrency exchange service providers must register with FinCEN, implement an AML/CFT program, maintain appropriate records, and submit reports to the authorities. Examples of CeFi include CoinBase, Binance, Huobi, etc.

Unlike DeFi, CeFi is permissioned as users have to provide their personal information through KYC (Know Your Customer) processes. It is also trust-based as users have to trust the central authority or third party that manages their funds and transactions. They have to rely on their reputation, credibility, and security measures to ensure the safety and efficiency of their services. Similarly, users have to deposit or store their funds and assets in a central platform or exchange that holds the private keys for their crypto wallets making CeFi custodial. This means that they do not have full control or ownership over their funds and assets, and they are exposed to the risk of losing them in case of a hack, theft, or insolvency.

Advantages of CeFi

Established infrastructure and user-friendly interfaces: CeFi platforms typically offer well-developed user interfaces and familiar financial services, making them accessible to a wider audience.

Regulatory compliance and customer protection: CeFi entities operate within regulatory frameworks, providing a layer of oversight and protection for customers, including measures such as KYC (Know Your Customer) and AML (Anti-Money Laundering) checks. For instance, the Securities and Exchange Commission (SEC) sued Binance, the world’s largest cryptocurrency exchange for allegedly violating securities regulation in June 2023. However, after a prolonged dispute, Binance and the United States SEC reached a successful resolution.

Customer support and dispute resolution: CeFi platforms often provide customer support and mechanisms for dispute resolution, offering users assistance in case of issues or conflicts.

Advanced services and features: CeFi platforms offer more advanced and sophisticated services and features that may not be available or feasible in DeFi, such as margin trading, derivatives, futures, options, staking, interest accounts, insurance, fiat on-ramps, and others.

DeFi Vs CeFi

With the introduction of the Internet, most banks began going online. As far back as the mid-1990s, by the end of 2000, most financial institutions introduced online offices and web banking to their customers. Despite how popular online banking seems to be today, some people still prefer the brick-and-mortar system of banking with checkbooks and safe deposit locks. We can compare DeFi and CeFi to traditional and online banking. Despite serving the same similar purposes, there is a vast world of difference between them.

Key differences

| Features | DeFi | CeFi |

| Governance and decision-making processes | Operates under decentralized governance models. | Controlled by a central authority. |

| Complexity | Technical know-how required due to the complex UI/UX | Easy to navigate with simple UI/UX |

| Privacy | Pseudo-anonymous hence users’ identities are protected | AML and KYC reveal the owners’ address |

| Control over funds and assets | Self-Custody: Users have full control over their funds and assets. | Exchange custody, which may introduce counterparty risk. |

| Security and risk management | Security challenges are primarily related to smart contract vulnerabilities. | Centralised risk management protocols. |

| Accessibility and global reach | Global accessibility which allows anyone with an internet connection to participate. | Limitations in terms of geographic reach based on local regulations. |

| Scalability and transaction speed | Often faces scalability challenges | Offers faster transaction speeds and higher scalability. |

| Trading Prices | Determined by AMM protocols | Use of Order books |

| Fiat conversion | Limited on ramps | Faster and better conversion |

This vs That: Which solution to pick on DeFi vs CeFi platforms

DeFi and CeFi rely on blockchain technology as the core to carry out their activities. While DeFi utilises Decentralised Exchanges (DEXs) CeFi relies on Centralised Exchanges (CEX) to carry out transactions. Depending on the user’s needs, preferences, and risk tolerance, DeFi vs CeFi may offer better solutions for different use cases and scenarios.

Here are some examples:

Spot trading: Users who want to buy and sell crypto assets for quick delivery may prefer CeFi platforms that offer more liquidity, lower fees, and user-friendly interfaces. For example, KuCoin and Binance can facilitate Spot trading, borrowing, margin trading, native stablecoin, lending, payments and more. Users who want more privacy, security, and control over their funds may prefer DeFi platforms that offer peer-to-peer transactions without intermediaries.

Derivatives trading: Users who want to trade crypto derivatives such as futures, perpetual contracts, and options may prefer CeFi platforms that offer more advanced and sophisticated services, features, and tools. Users who want more transparency, fairness, and innovation may choose DeFi platforms that offer novel and experimental products that are governed by smart contracts. Lyra, Hedera, Ribbon Finance and Synthetix are some DeFi platforms that offer derivatives trading.

Asset management: Users who want to entrust their crypto assets to professional managers who can provide them with returns, diversification, and risk management may prefer CeFi platforms that offer asset management services such as Grayscale Investments, Galaxy Digital, BlockFi, etc. Users who want to manage their own crypto assets without giving up custody or control may prefer DeFi platforms that offer self-sovereign asset management services such as Yearn Finance, Compound Finance, Aave Protocol, etc.

Staking: Users who want to stake their crypto assets to earn rewards may prefer CeFi platforms that offer staking services such as Gemini, Binance, Coinbase, etc. These platforms may provide more convenience, security, and flexibility for users who do not want to deal with technical issues or lock-up periods. Users who want to stake their crypto assets directly on the native blockchain networks may prefer DeFi platforms that offer staking services such as PancakeSwap, SushiSwap etc.

The Future of DeFi and CeFi

DeFi vs CeFi are two different approaches to providing financial services using crypto assets and blockchain technology. They may offer different use cases and scenarios but in the future, they may converge and integrate creating a more diverse and dynamic financial ecosystem that leverages the best of both worlds. In the future, we may see the birth of hybrid platforms and services where DeFi and CeFi features can exist on one platform. Currently, some exchanges offer both centralised and decentralised lending options. Also, in the near future, some platforms and services may enable cross-chain bridges and interoperability between different blockchains and networks that support DeFi or CeFi applications and protocols. This would allow users to move their funds and assets across different platforms and services without friction or loss of functionality.

The future of DeFi and CeFi may also depend on the evolving regulatory landscape and its impact on both sectors. As cryptocurrency and blockchain technology become more mainstream and widely adopted, regulators and policymakers may impose more rules and regulations that affect the operations, performance, and security of DeFi or CeFi platforms and services.

Disclaimer: Educational Content Only – No Financial Advice Offered